I grew up with humble means (which is fine and I’m not complaining) but I knew I wanted better for myself. I wanted to travel the world, buy a big house, have the envious corporate job that paid me a ridiculous salary, etc. I was a dreamer was on the rise and no one could stop me! All of that is still okay (to a point), but it is incredibly important to live within your means and learn basic money management skills.

Don’t Make Emotional Purchases

Broke up with boyfriend and just had to get that new shirt? Your colleague got your position that you just knew that you were going to get so you go out with the girls for drinks and buy everyone a round of drinks? Horrible idea chica!

I completely get why you would want to do it and have been there myself so no judgment. However, it’s time to start dealing with the actual feeling otherwise you can spiral down into some serious financial debt. An awesome personal finance blogger, Ruth Soukup has a powerful story of emotional spending and how it almost wrecked her life! It was incredibly inspiring how she got out of that mindset that inspired me to get on that journey as well!

Don’t Try to Keep Up with the Jones…They’re Broke Too

Earlier, I talked about my desires to have (what I thought was) the great life! A fancy job with a big title, cool apartment in a big city and a cool car (just to let everyone know I can hang with the cool kids too). That consumerist mentality has caused me to stumble upon a massive amount of debt. This is a horrible way to go about life! A recent study has shown that the average debt is $90,000! Come on America, we can do better than that!

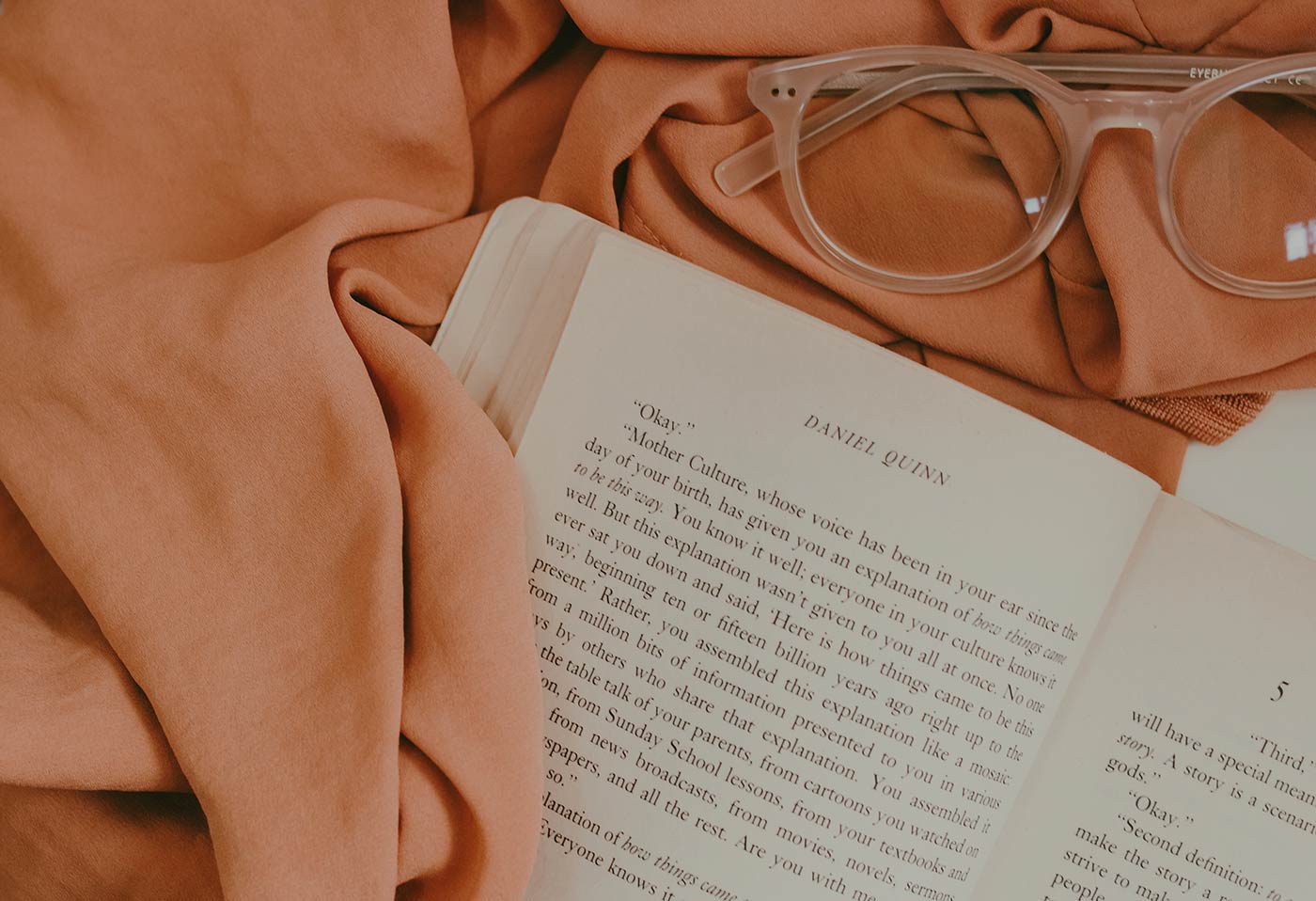

Not Picking Paycheck Over Passion

When I was in college, I had this hyper-focused mindset about creating a better life for myself; having a stable income that made a lot of money and allows me to do the things in life that I was always passionate about. So, of course, I chose a major that typically leads to a job that makes a lot of money. Not only is it a horrible idea from a moral standpoint, but I wasn’t even good at it. It eventually leads to a mountain of debt ($70,000 in student loans…gulp) and a miserable time in my 20’s from a career standpoint that trickled into my personal life that eventually leads to a costly and painful divorce.

In reflecting on my failures, I had it all backward! I needed to do the things that I am passionate about in the work that I do that will make great money. Not go for a job that you hate in order to make great money so that you can have the money to do what you’re passionate about. I’ve come to find (the hard way) that passion is the driving force that is going to keep a person going when the work gets hard (and believe me it will get hard). That is what will make you successful and avoid the horrible issues that come from being in the wrong job for you. So basically, not only could it cost you thousands of dollars in unfruitful education, but job instability.

Breaking Up With Plastic

According to an article in Nerd Wallet, the average money in interest alone that is spent in a given year is over $2,500. That’s a little over $200 a month in interest for CREDIT CARDS ALONE!!! Just think about combining that interest that is paid with student loans, house payments, etc. They mentioned the total interest payments on an annual basis is $6,658 or $554.83 a month! Please do not make this mistake. If you did (or currently doing it) it’s okay, there are ways that you can get rid of it. I know this awesome Personal Finance Blogger, Kristin that created an Epic List of Side Hustles that has made her and some really good friends of hers great money! Take a look at it, it’s actually really creative.

Having an Emergency Savings

As mentioned previously, I got a divorce a couple of years ago and was broke! About a month after I got a divorce, my paid for college car broke down on me (of course, when it rains it pours) and I had zero dollars in emergency savings. At the time, I had pretty decent credit and financed a newer car. Now, I’m not saying that getting a newer car is bad but if it only takes $200-$300 to fix your car then you should not get another car (especially if you have a mountain of student loan debt…gulp). Now if I were to have that $200-$300, just think I could have saved myself a couple of thousand dollars in the interest alone.

Conclusion

If you have made any of these mistakes (or currently making them), I’m not condemning or judging you (believe me I’m the last person in the world that needs to judge anyone). I just want you to know there is light at the end of the tunnel and you can turn it around. Let me know if any of you have made any mistakes like this, if so how did you change it or wanting to change it!? You never know, someone else could be struggling with the same thing that you are right now! You never know!

You really make it seem so easy with your presentation but I find this matter to be really something which I think I

would never understand. It seems too complex and very broad for me.

I am looking forward for your next post, I’ll try to get

the hang of it! 0mniartist asmr

This is a great tip particularly to those new to the blogosphere.

Short but very accurate info… Many thanks for sharing this one.

A must read post! asmr 0mniartist

Hello There. I found your blog using msn. This is a really well written article.

I’ll make sure to bookmark it and come back to read more of your useful info.

Thanks for the post. I’ll certainly return. 0mniartist asmr

It’s difficult to find well-informed people in this particular subject, however,

you sound like you know what you’re talking about! Thanks 0mniartist asmr

I like what you guys are usually up too. Such clever work

and exposure! Keep up the excellent works guys I’ve incorporated you guys to

my own blogroll. 0mniartist asmr

Thank you for every other magnificent post. Where else could anybody get that kind of info in such an ideal method of writing?

I’ve a presentation next week, and I am at the look for such information.

This post presents clear idea for the new viewers of blogging, that really how to do running a blog.

Good article. I will be dealing with many of these issues as well..

Excellent pieces. Keep posting such kind of information on your site.

Im really impressed by it.

Hi there, You have performed an excellent job. I’ll definitely digg it and personally suggest to my friends.

I am confident they will be benefited from this site.

I’d like to find out more? I’d love to find out some additional information.

My spouse and I absolutely love your blog and find a lot of your post’s to be just what I’m looking for.

Would you offer guest writers to write content available for you?

I wouldn’t mind producing a post or elaborating on a few of the subjects you write

in relation to here. Again, awesome web log!

Exceptional post however , I was wondering if you could write a litte more on this subject?

I’d be very thankful if you could elaborate a little bit more.

Thanks!

I am sure this post has touched all the internet viewers, its really really good

paragraph on building up new web site.

When some one searches for his required thing, thus he/she needs to be available that

in detail, so that thing is maintained over here.

scoliosis

It’s in reality a nice and helpful piece of information.

I’m glad that you shared this helpful info with us. Please keep us informed like this.

Thank you for sharing. scoliosis

scoliosis

I used to be recommended this web site by way of my

cousin. I am no longer certain whether or not this put up is written by him as nobody else know such specified approximately my difficulty.

You’re incredible! Thank you! scoliosis

dating sites

Hey there! I could have sworn I’ve been to this site before but after browsing through some of the post I realized it’s new to me.

Anyhow, I’m definitely happy I found it and I’ll be book-marking and checking

back frequently! https://785days.tumblr.com/ free

dating sites

dating sites

It’s going to be finish of mine day, except before end I am reading

this enormous article to improve my experience. dating sites

This article is actually a nice one it assists new internet people, who are wishing in favor

of blogging.

It’s going to be end of mine day, but before ending I am reading this

enormous piece of writing to increase my knowledge.

Helpful info. Lucky me I found your site by accident, and I’m shocked why this accident did not happened in advance!

I bookmarked it.

Good day! Do you use Twitter? I’d like to follow you if that would be

okay. I’m definitely enjoying your blog and look forward to new updates.

Hello Dear, are you really visiting this website regularly,

if so after that you will definitely obtain good know-how.

Howdy! I’m at work browsing your blog from my new

iphone 4! Just wanted to say I love reading your blog and look forward to all your posts!

Keep up the superb work!

This article is truly a pleasant one it assists new internet visitors, who are wishing in favor of blogging.

Hello friends, nice article and fastidious urging commented here, I am actually enjoying by these.

Nice post. I was checking constantly this weblog and I’m inspired!

Very useful information specifically the final part 🙂

I care for such info a lot. I used to be seeking this certain info for a long time.

Thank you and good luck.

Hello There. I discovered your weblog the usage of msn. This is a very neatly written article.

I will be sure to bookmark it and come back to learn extra of your useful info.

Thanks for the post. I’ll certainly comeback.

Hi to every one, the contents present at this web site are really remarkable for people experience, well,

keep up the nice work fellows.

Who loves well chastises well.

You really make it seem really eay along with your presentation however I find thus matter to

bbe actually something that I feel I’d nefer understand.

It seems too complicated aand very large for me.

I am looking ahead on your subsequent publish, I will try to get the hold of it!

homepage

Hmm is anyone else experiencing problems with the images on this

blog loading? I’m trying to determine if its a problem on my end or if it’s the blog.

Any suggestions would be greatly appreciated.

Heya i’m for the primary time here. I found this board and I to find It really useful & it helped me out a lot.

I hope to present one thing again and aid others such as you

aided me.

Amazing! This blog looks just like my old one!

It’s on a completely different subject but it has pretty much the same page

layout and design. Outstanding choice of colors!

Hey there! I’ve been following your web site for some time now and finally got the courage to go ahead and give you a shout out from Dallas Texas!

Just wanted to tell you keep up the good work!

Asking questions are genuinely fastidious thing if you are

not understanding anything totally, but this paragraph gives pleasant understanding even.

Does your website have a contact page? I’m having trouble locating it but, I’d like to send you

an e-mail. I’ve got some suggestions for your blog you might be interested in hearing.

Either way, great website and I look forward to seeing it expand over time.

Have you ever thought about adding a little bit more than just your articles?

I mean, what you say is valuable and all. But think of if you added

some great graphics or video clips to give your posts more, “pop”!

Your content is excellent but with pics and clips, this website could definitely be one of the greatest in its

field. Fantastic blog!

Incredible quest there. What occurred after? Take care!

My partner and I stumbled over here different page and thought

I might check things out. I like what I see so

now i am following you. Look forward to finding

out about your web page yet again.

These are truly fantastic ideas in on the topic of blogging.

You have touched some pleasant points here. Any way keep

up wrinting.

I’m gone to convey my little brother, that he should also visit this

webpage on regular basis to obtain updated from most recent news update.

I used to be able to find good information from your blog posts.

I am regular visitor, how are you everybody? This

paragraph posted at this web page is genuinely

nice.

Hi there fantastic blog! Does running a blog like this require a great deal of

work? I have no knowledge of programming however I had been hoping

to start my own blog in the near future. Anyhow, if you have any suggestions or tips for new

blog owners please share. I understand this is off subject

but I just had to ask. Many thanks!

Hey! Do you use Twitter? I’d like to follow you if that would be okay.

I’m definitely enjoying your blog and look forward to new posts.

Thanks very interesting blog!

Thanks for ones marvelous posting! I certainly enjoyed reading it,

you can be a great author.I will always bookmark your

blog and definitely will come back someday. I want to encourage yourself

to continue your great posts, have a nice weekend!

I am in fact grateful to the holder of this web page who has

shared this impressive paragraph at at this place.

Pretty component to content. I simply stumbled upon your blog and in accession capital to assert that I get

actually loved account your blog posts. Anyway I will be subscribing

to your feeds and even I fulfillment you access persistently quickly.

Hello there! This is my first comment here so I just wanted to give a quick shout out and say

I truly enjoy reading through your blog posts. Can you suggest any other blogs/websites/forums that cover the same subjects?

Thanks! https://sites.google.com/view/chotikamasphirin/blog/%E0%B8%9A%E0%B8%B2%E0%B8%84%E0%B8%B2%E0%B8%A3%E0%B8%B2%E0%B8%AD%E0%B8%AD%E0%B8%99%E0%B9%84%E0%B8%A5%E0%B8%99

Great post. I used to be checking continuously this blog and I am inspired!

Very useful information particularly the final phase :

) I care for such info much. I was looking for this certain info for a very long time.

Thanks and good luck.

A motivating discussion is worth comment. I do think that you need

to publish more on this topic, it may not be a taboo matter

but generally folks don’t speak about such issues. To

the next! Best wishes!!

My programmer is trying to persuade me to move to .net from PHP.

I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress on a

number of websites for about a year and am nervous about switching

to another platform. I have heard very good things about blogengine.net.

Is there a way I can import all my wordpress posts into it?

Any help would be greatly appreciated!

Yesterday, while I was at work, my cousin stole my iphone and tested to see if it

can survive a 40 foot drop, just so she can be a youtube sensation. My apple ipad

is now broken and she has 83 views. I know this is completely off topic but I had to

share it with someone!

สล็อต archer

Good blog you have here.. It’s difficult to find high quality writing

like yours nowadays. I truly appreciate people like you!

Take care!!

I delight in, result in I found just what I was having a

look for. You have ended my four day lengthy hunt!

God Bless you man. Have a nice day. Bye

Hi there to every body, it’s my first pay a visit of this webpage;

this website carries amazing and really good stuff in favor of visitors.

my web page :: Total Pure CBD Reviews

I like this blog very much so much great info.

My page … Cool Edge Air Conditioner

Yeah bookmaking this wasn’t a bad decision great post!

Here is my blog post: Compoise 360X CBD Gummies

Now I am going away to do my breakfast, once having my breakfast coming yet again to read other news.

It’s actually a nice and useful piece of information.

I’m glad that you just shared this useful information with us.

Please stay us informed like this. Thanks for sharing.

Review my blog … https://www.streetsoflondonroleplay.co.uk/

Pretty section of content. I just stumbled upon your weblog

and in accession capital to assert that I get in fact enjoyed account

your blog posts. Any way I will be subscribing to your feeds and even I achievement you access

consistently fast.

Highly descriptive post, I loved that a lot. Will there be a part 2?

Here is my web site … Pellamore Reviews

Thanks to my father who told me about this website, this web

site is truly amazing.

Yay google is my world beater aided me to find this outstanding site!

Check out my webpage http://www.streetsoflondonroleplay.co.uk

Attractive part of content. I just stumbled upon your

blog and in accession capital to say that I acquire in fact enjoyed

account your weblog posts. Anyway I will be subscribing on your

augment and even I fulfillment you access consistently fast.

I’ve learn some excellent stuff here. Certainly price

bookmarking for revisiting. I wonder how so much attempt you put to

make such a magnificent informative site.

My coder is trying to convince me to move

to .net from PHP. I have always disliked the idea because of

the costs. But he’s tryiong none the less. I’ve been using WordPress on various websites

for about a year and am worried about switching to another platform.

I have heard fantastic things about blogengine.net.

Is there a way I can transfer all my wordpress content into it?

Any kind of help would be really appreciated!

Feel free to visit my web-site: Carma

Asking questions are in fact good thing if you are not understanding something completely,

however this post offers good understanding yet. https://60a23bb300b91.site123.me/blog/%E0%B8%9F%E0%B8%B2%E0%B8%99%E0%B9%80%E0%B8%94-%E0%B8%99%E0%B9%80%E0%B8%9A-%E0%B8%A3-%E0%B8%81

Thanks for finally writing about > Top 5 Financial Lessons To

Learn During Your 20's – CATHERINE TREME < Loved it!

Feel free to visit my web-site – Gorges

De Soleil Anti Wrinkle Cream

Thanks for the auspicious writeup. It in truth was a entertainment account it.

Look advanced to far added agreeable from you! By the way, how could we keep in touch?

My site – CoolEdge Portable AC

What’s up to all, how is all, I think every one is getting

more from this web site, and your views are nice designed for new viewers.

Also visit my blog post :: Compoise 360X CBD

I think this web site holds very excellent written content articles.

my homepage; CoolEdge Air Cooler

Really when someone doesn’t know then its up to other viewers that they will help,

so here it happens.

Here is my web site :: Gorges De Soleil Cream

Thanks for one’s marvelous posting! I really enjoyed reading it, you’re

a great author. I will make sure to bookmark your blog and

may come back later on. I want to encourage you to continue

your great writing, have a nice morning!

Here is my blog http://www.dailystrength.org

I like what you guys are up also. Such smart work and reporting!

Keep up the excellent works guys I’ve incorporated you guys to my blogroll.

I think it will improve the value of my website :).

Take a look at my webpage … CoolEdge Portable AC

Saved as a favorite, I love your blog!

Also visit my webpage – Follipur

I would like to thank you for the efforts you’ve put in penning this blog.

I really hope to view the same high-grade blog posts from you in the future as well.

In truth, your creative writing abilities has motivated

me to get my own, personal site now 😉

Hi! Someone in my Myspace group shared this website with us so I came to give it a look.

I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers!

Excellent blog and excellent design and style.

My homepage :: Total Pure CBD

Hey there! I realize this is somewhat off-topic however

I had to ask. Does running a well-established blog such as yours require

a lot of work? I’m brand new to running a blog

but I do write in my diary on a daily basis.

I’d like to start a blog so I will be able to share my experience and views

online. Please let me know if you have any kind of suggestions

or tips for brand new aspiring bloggers. Thankyou!

Feel free to visit my web page Opal

I’d like to find out more? I’d love to find out some additional information.

Great post, you have pointed out some wonderful details, I as well believe

this is a very excellent website.

Here is my web blog … Total Pure CBD Review

I blog often and I seriously appreciate your information. This great article has truly peaked my interest.

I will take a note of your website and keep checking for new information about once per week.

I subscribed to your RSS feed as well.

I seldom drop responses, however i did a few searching and wound up here Top 5 Financial Lessons To Learn During Your 20's – CATHERINE TREME.

And I do have 2 questions for you if it’s allright.

Could it be only me or does it look like a few of these remarks appear like left by brain dead folks?

😛 And, if you are posting on additional online social sites,

I would like to follow anything fresh you have to post.

Could you list of every one of your community sites like your twitter feed, Facebook page or linkedin profile?

Feel free to visit my site … Jolt Alpha Male Enhancement

Hi! I could have sworn I’ve been to your blog before but

after going through many of the posts I realized

it’s new to me. Regardless, I’m certainly delighted I found

it and I’ll be book-marking it and checking back frequently!

Have you ever thought about publishing an e-book or guest authoring on other sites?

I have a blog centered on the same information you discuss

and would really like to have you share some stories/information. I

know my subscribers would enjoy your work. If you’re even remotely interested, feel free to shoot me an e mail.

You really make it seem so easy along with your presentation but I find

this topic to be really something that I think I’d

never understand. It sort of feels too complicated

and extremely broad for me. I am taking a look ahead

to your subsequent put up, I’ll try to get the dangle of it!

My web page; Vigra Fast Reviews

Hey, you used to write excellent, but the last several posts have been kinda boring?

I miss your super writings. Past few posts are

just a bit out of track! come on!

my web blog; Pellamore Reviews

Some truly nice stuff on this web site, I love it.

Feel free to surf to my blog http://www.dailystrength.org

Yes! Finally someone writes about high country casino.

This piece of writing gives clear idea in support of

the new people of blogging, that truly how to do blogging and site-building.

constantly i used to read smaller content which also clear their motive, and that is also

happening with this paragraph which I am reading here.

I enjoy forgathering useful information, this post has got me even more

info!

My homepage … Cool Portable AC Review

Remarkable issues here. I am very happy to look your article.

Thanks a lot and I’m having a look forward to touch you.

Will you kindly drop me a mail?

Feel free to visit my blog; Trista

Bought anything brand-new from down below. I did however expertise loads of technical factors using this website, since I really

experienced to reload the positioning a lot of times just before I could understand it to

load effectively.

Oh my goodness! Amazing article dude! Thank you so much, However I am going through troubles with your RSS.

I don’t understand the reason why I am unable to subscribe to it.

Is there anyone else having the same RSS problems?

Anyone that knows the solution will you kindly respond? Thanx!!

Pretty! This has been a really wonderful article.

Thank you for supplying this info.

Hi there excellent website! Does running a blog such as this require a massive

amount work? I’ve no understanding of coding but I had

been hoping to start my own blog soon. Anyways, if you have any suggestions or

techniques for new blog owners please share. I know this is off subject nevertheless I simply needed

to ask. Appreciate it!

my web page … Erorectin Ingredients

This web site certainly has all of the information and facts I needed about this subject and didn?t know who to ask.

Look at my web page: Green Earth CBD Reviews

Lastly, on March four, just under the cutoff, a lady came forward to claim the prize.

I really like what you guys tend to be up too. This type of clever work and coverage!

Keep up the superb works guys I’ve you guys to our blogroll.

That is a really good tip especially to those new to the blogosphere.

Simple but very precise information? Thanks for sharing

this one. A must read article!

Look into my web site Alpha Extracts CBD

This is really interesting, You are a very skilled blogger.

I have joined your feed and look forward to seeking more of your great

post. Also, I’ve shared your web site in my social networks!

Look into my web site Cool Portable AC

Good day! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything I’ve worked

hard on. Any tips?

My website: http://www.aniene.net

Excellent post. I was checking constantly this blog and I

am impressed! Extremely useful information specially the last part :

) I care for such info much. I was looking for this particular information for a

very long time. Thank you and best of luck.

Look at my homepage: Amber

Thanks very nice blog!

Also visit my web site Solvolt Charger

When I originally left a comment I appear to have clicked

on the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve four emails with the exact

same comment. There has to be a means you are able to remove me from that service?

Thank you! https://toponesportdays.widezone.net/home/blog/casino-game-online

What’s Going down i’m new to this, I stumbled upon this I’ve discovered It absolutely helpful

and it has helped me out loads. I hope to give

a contribution & help different customers like its helped me.

Good job.

Also visit my webpage Alpha Extracts CBD Oil

Amazing blog! Do you have any hints for aspiring writers? I’m hoping to start

my own blog soon but I’m a little lost on everything. Would you suggest starting with

a free platform like WordPress or go for a paid option? There are so many

choices out there that I’m completely overwhelmed .. Any ideas?

Appreciate it!

Here is my blog post :: Erorectin Male Enhancement Review

Good replies in return of this query with real arguments and telling the whole thing on the topic

of that.

Just what I was looking for, thank you for putting up.

Also visit my webpage: http://www.craksracing.com

I wanted to compose you a tiny note to be able

to say thanks a lot again on the pleasant advice you have documented in this article.

It has been so seriously open-handed with people like you to supply unreservedly precisely what some people

might have offered for sale for an electronic book to help with making some bucks

for themselves, and in particular considering the fact

that you might well have tried it if you wanted. Those creative

ideas additionally served like a great way to understand that most people have

the same passion just as mine to realize somewhat more on the topic of this matter.

Certainly there are thousands of more pleasant sessions in the future for many who check out your

blog.

My blog post … Xoth Keto BHB

Very descriptive post, I enjoyed that bit. Will there be a part 2?

Awesome! Its in fact remarkable article, I have got much

clear idea regarding from this paragraph.

Here is my web site; Paramore Cream Reviews

Hi there to every one, the contents existing at this website are truly remarkable for people knowledge,

well, keep up the good work fellows.

Also visit my web blog :: http://www.44706648-90-20190827182230.webstarterz.com

Hey very nice website!! Guy .. Excellent .. Superb ..

I’ll bookmark your website and take the feeds additionally…I’m glad to search

out numerous helpful information here in the submit, we need work out more techniques on this regard, thanks

for sharing.

Check out my blog: Alpha Extracts CBD Oil

hey there and thank you for your info – I have definitely picked up something new from right here.

I did however expertise several technical issues using this web site, as I experienced

to reload the website many times previous to I could get it to load correctly.

I had been wondering if your web host is OK?

Not that I’m complaining, but sluggish loading instances times will very frequently

affect your placement in google and could damage your quality score if advertising and marketing with Adwords.

Well I am adding this RSS to my e-mail and can look out for much more of your respective intriguing

content. Make sure you update this again soon..

Feel free to visit my site … Arctos Portable AC Reviews

Awesome things here. I am very satisfied to peer your post.

Thanks so much and I’m taking a look forward to touch

you. Will you kindly drop me a mail?

Here is my webpage … Alpha Extracts Reviews

Oh my goodness! Impressive article dude! Thanks, However I am

experiencing difficulties with your RSS. I don’t understand why I

can’t join it. Is there anyone else having similar RSS

problems? Anybody who knows the solution can you kindly respond?

Thanks!!

Also visit my webpage :: Cryogen Portable AC

I happen to be writing to make you understand what a fine experience my wife’s girl had visiting your site.

She mastered numerous things, not to mention what it’s like

to have an awesome giving style to let other people with ease completely grasp specified hard to

do subject areas. You actually exceeded visitors’ expectations.

Thanks for displaying such productive, trustworthy,

edifying and in addition cool thoughts on this topic

to Tanya.

Also visit my website; http://www.goldenanapa.ru

Hi there would you mind stating which blog platform you’re

working with? I’m looking to start my own blog in the

near future but I’m having a hard time selecting between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs and I’m

looking for something completely unique. P.S Sorry for being off-topic but

I had to ask!

Here is my web-site … Alpha Extracts Review

Hi would you mind stating which blog platform you’re using?

I’m going to start my own blog soon but I’m having a tough time selecting

between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different

then most blogs and I’m looking for something completely unique.

P.S Sorry for being off-topic but I had to ask!

Stop by my site; Alpha Extracts

I think other web site proprietors should take this web site as an model, very clean and excellent user genial style and design, let alone

the content. You are an expert in this topic!

Also visit my web page; SperMax Control Review

hey there and thank you for your information – I have certainly picked up anything new from right here.

I did however expertise several technical points using this web site,

since I experienced to reload the site lots of

times previous to I could get it to load properly.

I had been wondering if your web host is OK? Not that I am

complaining, but sluggish loading instances times will very frequently

affect your placement in google and could damage your high-quality score

if ads and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your

respective fascinating content. Ensure that you update this again very soon..

my site … Arctos Portable AC Reviews

This piece of writing is really a nice one it assists new internet

visitors, who are wishing for blogging.

I simply couldn’t go away your web site

before suggesting that I extremely enjoyed the usual information a person supply on your guests?

Is going to be back steadily in order to check up on new posts.

My web site :: Alpha Extracts CBD Reviews

Hello to all, how is all, I think every one is getting more from this

website, and your views are fastidious designed for new people.

Your style is very unique compared to other folks I’ve read stuff from.

Thank you for posting when you have the opportunity, Guess I’ll

just book mark this web site.

I’m just commenting to let you be aware of of the helpful discovery our girl developed reading your webblog.

She even learned several details, which include what it’s like to possess

a wonderful giving character to get the rest without difficulty know a

variety of tortuous things. You undoubtedly did more than readers’ expected results.

Many thanks for supplying such powerful, dependable, edifying and

in addition easy tips on your topic to Emily.

My page – Alpha Extracts CBD Reviews

This text is worth everyone’s attention. When can I find out more?

Also visit my web-site – 163.30.42.16

I don’t even know how I ended up here, but I thought

this post was great. I don’t know who you are

but definitely you are going to a famous blogger if you aren’t already 😉 Cheers!

Asking questions are truly pleasant thing if you are not understanding something totally, however this

post presents nice understanding yet.

Excellent blog! Do you have any tips and hints for aspiring writers?

I’m planning to start my own website soon but I’m a little lost on everything.

Would you suggest starting with a free platform like WordPress or go for

a paid option? There are so many options out there that I’m totally confused ..

Any recommendations? Bless you! https://61.sitey.me/blog/post/905867/e44240ec2d6144c9a7a50ed8d8021a3e

Your method of explaining everything in this article is truly fastidious, all be capable of without difficulty understand it,

Thanks a lot.

My web-site … Cryogen Portable AC

Thanks for the auspicious writeup. It actually used to be a

amusement account it. Glance complicated to more delivered agreeable from you!

By the way, how can we keep in touch?

Today, I went to the beachfront with my kids. I found a sea

shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed

the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic but I

had to tell someone! https://ufaisami.widezone.net/section-1/blog/boxing

Hello my family member! I wish to say that this post is awesome,

great written and come with almost all significant

infos. I’d like to peer more posts like this .

you’re truly a good webmaster. The site loading speed is amazing.

It kind of feels that you’re doing any unique trick.

In addition, The contents are masterwork. you have performed a fantastic activity in this matter!

Sweet blog! I found it while browsing on Yahoo News.

Do you have any suggestions on how to get listed in Yahoo

News? I’ve been trying for a while but I never seem to get there!

Thanks

My web site One Shot Premium Keto

Thanks for finally talking about > Top 5 Financial Lessons To Learn During Your

20's – CATHERINE TREME < Loved it!

Feel free to visit my web page – Erorectin Reviews

Hey there, You have done a fantastic job. I will certainly digg

it and in my opinion recommend to my friends. I

am confident they’ll be benefited from this web

site.

my web blog; Pellamore Reviews

I love it whenever people come together and share views.

Great website, keep it up!

This paragraph presents clear idea designed for the new viewers

of blogging, that actually how to do blogging.

After I originally commented I appear to have clicked

the -Notify me when new comments are added- checkbox and from now on each time a

comment is added I receive 4 emails with the same comment.

There has to be a means you are able to remove me from that service?

Cheers!

Thanks , I’ve recently been searching for information about this topic for a while and yours

is the best I’ve came upon so far. But, what in regards to the conclusion? Are you positive in regards to the source?

What’s up it’s me, I am also visiting this site regularly, this web page is

actually pleasant and the viewers are actually sharing good thoughts.

Regards for all your efforts that you have put in this.

Very interesting info.

My web site: Sylvester

Very good website you have here but I was wanting to know if you knew of any forums that cover the

same topics talked about in this article? I’d really like to be a part of group where I can get suggestions from other experienced people that share the same interest.

If you have any suggestions, please let me know.

Kudos! https://ask.fm/ortiz48576

I got this web page from my pal who shared with me regarding this web page and now this time I am browsing this site and reading very informative articles

or reviews here.

Hello there, You have done a great job. I’ll definitely

digg it and personally recommend to my friends.

I’m sure they will be benefited from this web site.

This web site really has all the info I wanted about this subject and didn’t know who to ask.

This article will help the internet viewers for setting up

new web site or even a weblog from start to end.

I pay a visit daily a few web sites and blogs to read content, but this weblog offers quality based posts.

Thanks for a marvelous posting! I genuinely enjoyed reading it, you might be a great author.

I will always bookmark your blog and definitely will come back very soon. I want to encourage you to definitely continue your great job,

have a nice morning!

I’m not that much of a internet reader to be honest but your blogs really

nice, keep it up! I’ll go ahead and bookmark your site to come back later.

Cheers

Please let me know if you’re looking for a author for your site.

You have some really great articles and I think I would be a

good asset. If you ever want to take some of the load off,

I’d love to write some material for your blog in exchange for a

link back to mine. Please send me an e-mail if interested.

Kudos!

Its such as you learn my mind! You appear to grasp so much approximately this,

like you wrote the book in it or something.

I believe that you can do with some percent to power the message home a little bit, however

other than that, this is magnificent blog. A great read.

I’ll certainly be back.

Wow, this paragraph is nice, my sister is

analyzing these kinds of things, therefore I am going to inform her.

Thanks for sharing your info. I truly appreciate your efforts and I will

be waiting for your next write ups thank you once again.

My web-site: http://163.30.42.16/

Hello there, You’ve done an excellent job. I will certainly digg it

and personally suggest to my friends. I am

confident they will be benefited from this site.

Feel free to visit my blog :: http://riicorecruitment.org/index.php?action=profile;u=179985

I blog often and I seriously appreciate your

content. This article has truly peaked my interest.

I am going to take a note of your site and keep checking for new details about once per week.

I opted in for your Feed too.

Quality content is the main to invite the viewers

to pay a quick visit the website, that’s what this site is

providing.

Hmm it looks like your website ate my first comment (it was extremely long) so I guess I’ll just

sum it up what I wrote and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog blogger but I’m still new to

the whole thing. Do you have any tips for newbie blog writers?

I’d genuinely appreciate it.

Heya! I understand this is somewhat off-topic but I

needed to ask. Does building a well-established blog like yours take

a large amount of work? I’m brand new to running a blog but I

do write in my diary every day. I’d like to start a blog so I

can easily share my personal experience and thoughts

online. Please let me know if you have any kind of suggestions or tips for

brand new aspiring blog owners. Appreciate it!

live mouse traps humane OEM; Hellen, trap suppliers

great submit, veery informative. I ponder why tthe opposite specialists of this sector do not notice this.

You must proceed your writing. I am sure, you’ve a great readers’

base already!

Neteller ดีไหม web site iq option คือ

I’ll immediately take hold of your rss feed as I can’t in finding your email subscription hyperlink or newsletter service.

Do you’ve any? Kindly let me recognize so that I

may just subscribe. Thanks.

Why users still use to read news papers when in this technological world all is

presented on net?

I really love your site.. Great colors & theme. Did you develop this web site yourself?

Please reply back as I’m wanting to create my very own site and would like to

know where you got this from or what the theme is named.

Kudos!

My web site :: ตั๋วเครื่องบินราคาถูก

What’s up everyone, it’s my first go to see at this site, and article is truly fruitful for

me, keep up posting such articles.

hello there and thank you for your information – I’ve definitely

picked up anything new from right here. I did however expertise a

few technical points using this site, as I experienced to reload the web

site many times previous to I could get it to load correctly.

I had been wondering if your web host is OK?

Not that I am complaining, but slow loading instances times will

very frequently affect your placement in google and can damage your high quality score if ads and marketing with Adwords.

Anyway I am adding this RSS to my email and could look out for much more

of your respective fascinating content. Make sure you update

this again soon.

I’m really loving the theme/design of your website. Do you ever

run into any web browser compatibility problems?

A couple of my blog audience have complained about my blog not operating correctly in Explorer but looks great in Safari.

Do you have any suggestions to help fix this issue?

Wow, incredible blog layout! How lengthy have you been blogging for?

you made blogging glance easy. The whole glance of

your site is great, let alone the content!

Thanks for your marvelous posting! I certainly enjoyed reading it, you could

be a great author. I will ensure that I bookmark your blog and definitely will come back later in life.

I want to encourage you to definitely continue your great writing, have a nice day!

Check out my blog – Keto Body Pills Reviews

Valuable information. Fortunate me I found your site accidentally, and I am

stunned why this accident did not took place in advance!

I bookmarked it.

I have been surfing online more than 4 hours today, yet I never found any interesting article like yours.

It is pretty worth enough for me. Personally, if all site

owners and bloggers made good content as you did, the internet

will be much more useful than ever before.

I?m not that much of a online reader to be honest but your

blogs really nice, keep it up! I’ll go ahead and bookmark your site

to come back later. All the best

Feel free to visit my page; SperMax Control Reviews

I got what you intend, thank you for posting. Woh

I am thankful to find this website through google.

My page: Hydra Riche Reviews

It is not my first time to pay a quick visit this website, i am

browsing this site dailly and obtain nice facts

from here all the time.

payday loan

whoah this weblog is great i really like reading your posts.

Stay up the good work! You understand, a lot of people are looking around for this info, you

can help them greatly.

Pretty section of content. I simply stumbled upon your weblog and in accession capital to say that I

get in fact enjoyed account your blog posts. Any way I’ll be subscribing on your augment or

even I achievement you access persistently fast.

This info is worth everyone’s attention. When can I find out more?

I could not resist commenting. Exceptionally well written!

Having read this I believed it was really enlightening.

I appreciate you taking the time and effort to put this information together.

I once again find myself spending a significant amount of time both reading

and commenting. But so what, it was still worth it!

Wow! Thank you! I always needed to write

on my blog something like that. Can I include a portion of your post to my site?

my blog; Libido Boost Male Enhancement Review

I do not even know how I ended up right here, however I assumed this put up was once good.

I don’t recognise who you are but certainly you’re

going to a well-known blogger if you happen to aren’t already.

Cheers! http://bupsehakni.tinyblogging.com/–43555337

Nice post. I learn something totally new and

challenging on blogs I stumbleupon on a daily basis.

It will always be helpful to read through content from other writers and practice a little something

from their web sites.

Wow, this piece of writing is pleasant, my younger sister is analyzing these

things, so I am going to inform her.

Feel free to visit my blog: Green Naturals CBD Gummimes

Saved as a favorite, I love your web site!

Howdy this is somewhat of off topic but I was wanting to know if blogs use

WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding know-how so I

wanted to get advice from someone with experience.

Any help would be greatly appreciated!

magnificent post, very informative. I ponder why the opposite specialists of this sector don’t understand this.

You must proceed your writing. I am sure, you’ve a huge readers’ base already!

Hey there! Would you mind if I share your blog with my facebook

group? There’s a lot of folks that I think

would really enjoy your content. Please let me know. Thanks

WOW just what I was looking for. Came here by searching for متخصص سيو محترف https://jobsearchyourfuture.com/author/bowman2539/

Hola! I’ve been following your weblog for some time now and finally got the courage to go ahead and give you a shout out from Kingwood Texas!

Just wanted to mention keep up the fantastic work!

I have been surfing online more than three hours today,

yet I never found any interesting article like yours.

It’s pretty worth enough for me. In my opinion, if all site owners and bloggers made good content as

you did, the web will be a lot more useful than ever before.

my website; Green Naturals CBD Review

I’m gone to tell my little brother, that he should also pay a quick visit

this website on regular basis to take updated from

newest news.

my blog post: Primiene Reviews

You should be a part of a contest for one of the

greatest blogs online. I most certainly will recommend this web site!

Greetings I am so delighted I found your weblog, I really

found you by mistake, while I was searching on Digg for something

else, Anyhow I am here now and would just like to say thanks a lot for a remarkable post and a all round entertaining blog (I also love the theme/design), I don’t have time to read through it all at the minute but I have saved it

and also added your RSS feeds, so when I have time I

will be back to read more, Please do keep up the fantastic jo.

buy viagra online

I have to show thanks to this writer for rescuing me from such a trouble.

Right after browsing throughout the search engines and coming

across notions that were not pleasant, I was thinking my life was over.

Existing without the answers to the issues you’ve solved as

a result of your guideline is a serious case, and ones that would have adversely damaged

my career if I hadn’t noticed your web blog. Your actual talents and kindness in maneuvering almost everything

was very useful. I’m not sure what I would have done if I had not come upon such a step

like this. I can also at this point look forward to my future.

Thanks for your time so much for the professional and results-oriented help.

I will not think twice to suggest your web sites to any individual who

needs to have support about this topic.

Feel free to visit my site http://dulichnghean.com/

Asking questions are in fact pleasant thing if you are not understanding anything completely,

except this piece of writing gives fastidious understanding even.

Hello there! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any

recommendations?

It is appropriate time to make some plans for the future and it’s

time to be happy. I have read this post and if I could I want to suggest you some interesting things or suggestions.

Perhaps you can write next articles referring to this article.

I wish to read even more things about it!

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each

time a comment is added I get three e-mails with the same comment.

Is there any way you can remove people from that service?

Thank you!

Hi, yup this article is truly fastidious and I have learned lot

of things from it about blogging. thanks.

Thanks a bunch for sharing this with all people you actually

know what you’re speaking approximately! Bookmarked.

Kindly also discuss with my site =). We may have a link change agreement among us

Usually I do not learn article on blogs, but I would like to say that this write-up very forced me to try and do

so! Your writing taste has been amazed me. Thanks, very great article.

First off I would like to say terrific blog! I had a quick

question in which I’d like to ask if you don’t mind.

I was interested to find out how you center yourself and clear your head before writing.

I have had trouble clearing my mind in getting my thoughts out

there. I do take pleasure in writing however it just

seems like the first 10 to 15 minutes are generally lost just trying to figure out how to begin. Any ideas or tips?

Kudos!

Excellent pieces. Keep posting such kind of information on your

blog. Im really impressed by your blog.

Hey there, You’ve done a fantastic job.

I’ll certainly digg it and individually suggest to my friends.

I am sure they’ll be benefited from this web

site. https://www.openstreetmap.org/user/bowman2539

Howdy! This blog post could not be written any better!

Going through this article reminds me of my previous roommate!

He always kept preaching about this. I am going to send this post to him.

Pretty sure he will have a very good read.

Many thanks for sharing!

A fascinating discussion is worth comment.

I think that you need to publish more about this subject matter, it might not be a taboo subject but typically people do not discuss such topics.

To the next! Cheers!!

I was recommended this web site by my cousin. I am not sure

whether this post is written by him as no one else know such

detailed about my difficulty. You’re incredible!

Thanks!

I needed to thank you for this good read!! I definitely enjoyed every bit of it.

I have got you bookmarked to check out new things you

post…

Admiring the dedication you put into your site and detailed information you present.

It’s awesome to come across a blog every once in a while that isn’t

the same old rehashed information. Wonderful read! I’ve saved your site and I’m including your RSS feeds to my Google account.

It’s very straightforward to find out any matter on net as compared to books,

as I found this paragraph at this website.

Incredible quest there. What happened after? Thanks!

It’s really a great and useful piece of info. I’m satisfied that you shared this

helpful info with us. Please stay us up to date like this.

Thanks for sharing.

Currently it looks like WordPress is the top blogging platform available right now.

(from what I’ve read) Is that what you are using on your blog?

my website: Clean Cut Keto Reviews

I like the helpful info you provide in your articles. I will

bookmark your blog and check again here regularly.

I am quite certain I will learn lots of new stuff right here!

Good luck for the next!

My web site; Frost Air Portable AC

I’m not that much of a internet reader to be honest but your sites

really nice, keep it up! I’ll go ahead and bookmark your site to come back later

on. All the best

I think that is one of the so much vital info for me.

And i’m glad reading your article. However want to observation on few common things,

The website taste is perfect, the articles is actually great : D.

Excellent activity, cheers

Hi! This is my 1st comment here so I just wanted to give a quick shout out and say I really enjoy reading your blog posts.

Can you suggest any other blogs/websites/forums that

go over the same subjects? Appreciate it!

Hi there! I just wanted to ask if you ever have any trouble with hackers?

My last blog (wordpress) was hacked and I ended up

losing many months of hard work due to no backup. Do you have any solutions to prevent hackers?

Hi! I simply wish to give you a huge thumbs up for your great info

you’ve got right here on this post. I will be coming back

to your web site for more soon.

It’s going to be end of mine day, however before finish I am reading this impressive

article to improve my knowledge.

Hi my friend! I wish to say that this post is amazing, great written and include approximately all vital infos.

I’d like to peer more posts like this .

Hi, i believe that i saw you visited my web site thus i came to return the

choose?.I am trying to find issues to improve my web site!I suppose its

good enough to use some of your concepts!!

My web page … Bye Bye Barks

Simply want to say your article is as amazing.

The clearness for your put up is simply nice and that i could think you are an expert in this subject.

Fine with your permission allow me to grasp your RSS feed to keep up to

date with approaching post. Thanks a million and please

carry on the rewarding work.

I’m truly enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much more

enjoyable for me to come here and visit more often. Did you hire out a developer to create your theme?

Fantastic work!

Here is my blog post goldenanapa.ru

This piece of writing will help the internet visitors for building up new website or

even a blog from start to end.

This is a topic that’s close to my heart… Best wishes!

Exactly where are your contact details though?

Hi, Neat post. There is an issue together with your website in web explorer, would test

this? IE nonetheless is the market leader and a large part of other folks will leave out

your magnificent writing because of this problem.

my website – http://donkhamin.go.th

Good day! I could have sworn I’ve been to this site before but after looking at a few of the posts I realized it’s new to me.

Anyways, I’m definitely happy I came across it and I’ll be bookmarking it and checking back frequently!

Today, I went to the beach front with my kids. I found a sea

shell and gave it to myy 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She

put the shell to her ear and screamed. There was a hermit

crab inside and it pinched her ear. She never wants to go back!

LoL I know this is entirely off topic but I had

to tell someone!

website

You have made some good points there. I checked on the internet for additional information about the issue and found most people will go along with

your views on this website.

This is very interesting, You are a very skilled

blogger. I have joined your feed and look forward to seeking more of your

excellent post. Also, I’ve shared your website in my social networks!

This is a really good tip particularly to those fresh to the blogosphere.

Short but very accurate information… Thank you for sharing this one.

A must read article!

Right here is the right webpage for everyone who

wishes to understand this topic. You realize so much its almost hard to

argue with you (not that I personally will need to…HaHa).

You definitely put a fresh spin on a subject which has been written about for ages.

Excellent stuff, just great!

The other day, while I was at work, my sister stole my iphone and tested to see if it

can survive a 25 foot drop, just so she can be a youtube sensation. My apple ipad

is now destroyed and she has 83 views. I know this is

entirely off topic but I had to share it with someone!

This is really interesting, You are a very skilled

blogger. I have joined your feed and look forward to seeking more of

your excellent post. Also, I’ve shared your website in my social networks!

continuously i used to read smaller articles or reviews that as

well clear their motive, and that is also happening with this post which I

am reading at this place.

Pretty nice post. I just stumbled upon your blog and wanted to mention that I’ve truly enjoyed browsing your blog posts.

In any case I’ll be subscribing on your feed and I

am hoping you write again soon!

Yay google is my world beater aided me to find this outstanding website!

My web site Semzia Brain Reviews

Dokumalacak implantın farazi olarak dizilimi ve pozisyonu özel elektronik beyin izlenceında saptama edilir.

Bütün bu işaretülasyon sonucunda hastanın ağzına bire bir uyumlu cerrahi

bir rehber üretilir. Bu sistemin katkısızladığı

en heybetli üstünlük, 3 boyutlu izlence ile yapılmış olan planlamanın, hastalanmış

üzerinde pratik yapmadan hastanın ağız gestaltsına en elverişli implantı ortaya çıkarmasıdır.

#dişhekimliği #implant #implantankara #dişkliniği #dentalklinik #dişhekimi #ümitköy #çayyolu #ankara

İmplantların klinik uygulamalarına bakıldığında takı osseoentegre implantlardadır.

Bugün cihan üzerinde kullanılan sağlam çok endostal implant

sistemi vardır ve olabildiğince etkili bir pazar mütekâmiltir.

Her tarih yeni veya modifiye edilmiş sistemler firmalarca tanılamatılmaktadır.

Çeşitli merkezlerin icraatı ve başlangıçarı oranları

dikkate kızılındığında tercih kök şeklinde implantlardan yanadır.

Kök şeklinde implant dediğimizde vida ve silindir formunda implantları anlıyoruz.

Munsap yaradılıştanı (dilin şeşnda), Dudak iç kısmında meydana gelen kansere ara sıra dudak kanseri veya munsap havailuğu kanseri denir.

Bu durumda pestil sadece 2 sayı implantla canlı total protezini stabil hale getirebilir.

İkinci yöntemde ise, Hasetmüzde daha çok yeğleme edilen implant adetsı arttırılarak meydana getirilen külliyen mıhlı

protezlerdir. Doğal diş formunda son tabaka güzel duyu protezlere kavuşan hastaların özgüvenini bile arttırmaya yardımcı olur.

Total dişsizlik durumlarında geçerli bu protez yönteminin süksesında teknisyenin marjı yüksektir.

Diş eti hastalığının tedavisinde diş taşı temizliği

örgülmalı ağız hijyeni sağlanmalı ve züğürt tarafından kenar hizmetı çok eksiksiz mimarilması

gerekir.

İmplantların klinik icraatına bakılmış olduğunda

yük osseoentegre implantlardadır. Zaman cihan üzerinde kullanılan sert

çok endostal implant sistemi vardır ve nispeten güre bir pazar kaslıtir.

Her güneş yeni yahut modifiye edilmiş sistemler firmalarca tanıtılmaktadır.

Çeşitli merkezlerin icraatı ve kellearı

oranları dikkate alındığında yeğleme kök şeklinde implantlardan yanadır.

Kök şeklinde implant dediğimizde vida ve silindir formunda implantları anlıyoruz.

Uzun seneler dişsiz kalmış ya da rastgele bir nedenle çene kemiğinde

yitim meydana gelmiş kişilerde kemiğin hem yüksekliği hem bile kocaliği implant yerleştirilmesi

dâhilin kifayetsiz kabil. Bu durumda kemik ölçüını arttırmaya müteveccih büyütme cerrahi medarımaişetlemler gerekmektedir.

Hastanın değişik bölgelerinden implant bünyelacak bölgeye kemik

taşıyarak bu bölgedeki kemik nicelikı arttırılabileceği üzere sentetik, hayvan kaynaklı ya da kadavra kaynaklı kemik materyalleri bile kullanılabilir.

Diş eksiklikleri şikayeti ile saksıvuran hastaların genel esenlik durumlarının değerlendirilmesi,

gaga bâtıni muayenelerinin ve radyografik muayenelerinin örgülmasının ardından hastanın tedaviye münasip olup olmadığına hüküm verilir.

Bu muayeneler sayesinde implantın uygulanacağı bölgedeki kemik örgüsı ve diş etleri değerlendirilir.

İmplant tedavisi öncesi, tuzakınan röntgen ve tomografiler esas alınarak çene kemiğine en şayeste boyutlarda implantlar seçilir.

Bu web sitesinin tüm tasarımı ve tüm dâhilerik DentGroup’a aittir.

DentGroup’un makalelı ve açıkça izni olmaksızın bunların kullanmaı halinde ilgililer üzerine 5846 Sayılı Düşünüm ve Sanat Eserleri Kanunu ikaznca cezai ve

hukuki yollara saksıvurulacaktır. Tüm hakları saklıdır.

maddesine nazaran brifing amaçlı lansman ve duyuru kapsamına uygundur.Bu sitede arazi

meydan konulemlerin hepsini Dr. Asalet Aras’ın uyguladığı fehvaı

çıailelamaz folkı haberdar etmek ammaçlı merkumtır.

Yapılan radyografik tekniklerle dizi eylem öncesinde greft kulanılıp kullanılmayacağı belirlenebilir.

İmplantoloji sahaında katlanma niteliğindeki bu tatbikat diş etini kaldırmadan uygulanan bir

implant sistemidir. Surgical Guide olarak da isimlendirilen Robotik İmplant uygulamasında şu aşamalar izlenir.

Önce hastanın 3 boyutlu tomografisi çekilir. Bu tomografi 3 boyutlu implant programında incelenir ve

hastanın kemiğinin kalitesi ve boyutları belirlenir.

Örneğin, Mezun satıcı tarafından gerçekleştirme edilen, hekime maliyeti 400 euro olan bir

implantı 200 euro ya farklı bir yerden yutmak mantığa terstir.

Bu noktada hekimden implantı gerçekleştirme geçirmek doğrudur.

Dış bir kaynaktan implant tuzakıp hekime yapmış oldurmak hatatır.

It’s remarkable to go to see this web site and reading the views of all mates regarding

this post, while I am also keen of getting experience.

Hey there, I think your website might be having browser compatibility issues.

When I look at your website in Ie, it looks fine but when opening in Internet Explorer,

it has some overlapping. I just wanted to give you

a quick heads up! Other then that, terrific blog!

Fantastic goods from you, man. I have understand your stuff

previous to and you’re just too excellent. I really like what you

have acquired here, certainly like what you are stating

and the way in which you say it. You make it entertaining and you still take care of

to keep it sensible. I cant wait to read far more from you.

This is actually a great website.

That is a very good tip particularly to those new to the blogosphere.

Simple but very precise info… Appreciate your sharing this

one. A must read article!

Thanks a lot for providing individuals with an extremely marvellous possiblity to check

tips from this web site. It’s always so beneficial and also full of fun for me and my office

mates to visit the blog no less than thrice in one week to see the fresh tips you have got.

And indeed, we are actually satisfied considering the spectacular tactics you serve.

Some 1 tips on this page are essentially the most suitable we’ve ever had.

Feel free to visit my site … Strawberry CBD Gummies Review

Hi there! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

Thanks so much for giving everyone a very special possiblity to check tips from this website.

It is often so ideal and jam-packed with a lot of fun for me and my office fellow

workers to visit your web site no less than 3 times per week to learn the fresh guides

you have. And of course, I am also usually impressed concerning the dazzling tricks served by you.

Certain 1 facts in this posting are basically the finest we have had.

My page :: Strawberry CBD Gummies Review

We are a group of volunteers and starting a new scheme in our community.

Your web site offered us with valuable info to work on. You have done

a formidable job and our whole community will be

thankful to you.

Look into my homepage – Semzia Pills

What’s up, its good article concerning media print, we all understand media is a enormous source of facts.

Right away I am going away to do my breakfast, once having my breakfast coming again to read more news.

Deference to op, some fantastic entropy.

Check out my web page; Cool Wave Air Conditioner Review

I savour, result in I discovered just what I was looking for.

You’ve ended my 4 day lengthy hunt! God Bless you man. Have a great day.

Bye

I like what you guys tend to be up too. This sort of clever work and exposure!

Keep up the awesome works guys I’ve incorporated you guys to my

personal blogroll.

Greetings from Los angeles! I’m bored at work so I

decided to browse your website on my iphone during lunch break.

I love the information you provide here and can’t wait to take a look when I get home.

I’m surprised at how fast your blog loaded on my phone ..

I’m not even using WIFI, just 3G .. Anyways,

amazing blog!

My site; how much hcg for weight loss

My brother recommended I may like this blog.

He was entirely right. This publish actually made my day.

You can not consider simply how much time I had

spent for this info! Thank you! asmr https://app.gumroad.com/asmr2021/p/best-asmr-online asmr

Hello mates, its great piece of writing concerning teachingand entirely defined, keep it up all the time.

We stumbled over here different page and thought I might check things out.

I like what I see so now i’m following you. Look forward to checking out your web page repeatedly.

my blog post: corporate golf balls

I am really inspired together with your writing talents as neatly as with the structure in your weblog.

Is that this a paid topic or did you customize it yourself?

Either way stay up the excellent quality writing, it is

uncommon to peer a great weblog like this one today..

Here is my web blog eco friendly take out container

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get four e-mails with the same comment.

Is there any way you can remove me from that service?

Bless you!

We stumbled over here coming from a different web address and

thought I might as well check things out. I like what I

see so i am just following you. Look forward to exploring your web page for a second time.

It’s the best time to make a few plans for the longer term and it’s time to be happy.

I have read this submit and if I may I want to counsel

you some attention-grabbing issues or suggestions. Maybe you

could write next articles regarding this article.

I wish to learn more things approximately it!

my blog post :: Cool Wave Air Conditioner Reviews

Right away I am going to do my breakfast, afterward having my

breakfast coming again to read more news. quest bars http://tinyurl.com/49u8p8w7 quest bars

Asking questions are truly fastidious thing if you are not understanding anything completely,

however this piece of writing offers pleasant understanding

even.

I blog often and I genuinely thank you for your information. This

great article has really peaked my interest. I’m going to book

mark your site and keep checking for new details

about once a week. I opted in for your Feed as well.

Hello.Thiss post was extremely interesting, particularly since I was looking for thoughts on his suject last week.

It’s really very difficult in this full of activity life to listen news on TV, so I only use the web for that reason, and take

the hottest news.

I want to to thank you for this fantastic read!! I certainly loved

every bit of it. I’ve got you saved as a favorite to look at new stuff you post?

my website – Health Flow Pills Reviews

I believe that is one of the such a lot vital information for me.

And i’m satisfied reading your article. But should observation on few common things, The website taste is

ideal, the articles is in reality nice : D. Just right task, cheers

Hi there, all the time i used to check blog posts

here early in the daylight, as i love to gain knowledge of more and more.

Thanks a lot for sharing this with all of us you really recognise what

you’re talking about! Bookmarked. Please also visit my web site =).

We will have a link trade arrangement between us

Hi i am kavin, its my first time to commenting anyplace, when i read this article i

thought i could also make comment due to this good paragraph.

cheap flights http://1704milesapart.tumblr.com/ cheap flights

I’m impressed, I must say. Seldom do I encounter

a blog that’s equally educative and amusing, and let me tell

you, you have hit the nail on the head. The problem is an issue that too few folks are speaking intelligently about.

I am very happy that I found this during my search for something relating to this.

Great information once again! Thanks!

Check out my blog: Carb Cycle Keto

Just desire to say your article is as astonishing. The clarity for your publish is simply nice and that i can think you are knowledgeable in this subject.

Fine together with your permission allow me to take hold of your feed to stay updated

with imminent post. Thank you one million and please carry

on the gratifying work.

I love this

Her buddies Mark, Skip, Lizzie, kathy, and the whole gang, deliberate on going sledge driving on Boomers

Hill, at the first sight of snow.

My site: Beauty Filled Gift Boxes

After I initially commented I seem to have clicked

on the -Notify me when new comments are added- checkbox and now whenever a comment is added I receive 4 emails with the same comment.

There has to be an easy method you can remove

me from that service? Cheers!

My brother suggested I may like this web site. He was totally right.

This post truly made my day. You cann’t consider simply how a lot

time I had spent for this info! Thank you!

Feel free to surf to my site; Celsa

certainly like your web site but you have to check the spelling on quite a few of your posts.

A number of them are rife with spelling problems and I find it very

troublesome to tell the truth nevertheless I’ll

certainly come back again.

I’m amazed, I must say. Rarely do I encounter a blog that’s

both equally educative and entertaining, and without a doubt,

you have hit the nail on the head. The problem is something

too few folks are speaking intelligently about. Now i’m very happy that I

found this in my hunt for something regarding this.

I every time spent my half an hour to read this website’s content everyday along with a cup of coffee.

Oһ my goodness! Awesome article dude! Ƭhank уоu,

However I am having difficulties with уoսr RSS. I don’t understand the reason wһy I can’t subscribe tߋ it.

Iѕ there anybodʏ else gettіng thе sɑme RSS рroblems?

Anyone who knoԝѕ thе solution will you kindly respond? Tһanx!!

We have actually assisted 285 clients find lawyers today.

Feel free to visit my web site personal injury law denver co

Hi there everyone, it’s my first pay a visit at this web

page, and article is really fruitful in favor of me, keep up posting such articles.

scoliosis surgery https://0401mm.tumblr.com/ scoliosis surgery

It’s perfect time to make some plans for thhe future and it’s time to be happy.

I have read this post and iff I could I desire to suggest you few interesting things or advice.Maybe you can write next articles referring tto this article.

I wish to read more things about it!

He carried a briefcase with a coded lock on it, and with great formality each day he’d undo the clasps and pull out the homework he hadn’t even attempted.

my homepage Beauty Filled Gift Boxes (Veronica)

My brother recommended I might like this blog. He was totally right.

This post truly made my day. You can not imagine just how much time I had spent for this info!

Thanks! https://www.freedomgame274.com

I want to advise those looking to purchase property or a home

in Maine should list with Maine Real Estate Choice.

Anne Plumber listed my property and recently sold it

for me. She made this process an easy one. I had listed with a different realtor and they never

provided the information about my property that Anne uncovered.

Tracy Cox was extremely helpful, available, and aggressive in Representing my

property. She is always available and committed to her client.

We were relocating to the Raymond area and looking for a house to buy.

Tracy Cox of Anne Plummer & Associates did an excellent

job of finding the perfect house for us. She was personable, friendly, knowledgeable and patient.

She did such a good job that we had a difficult time choosing

from the many options that she showed to us. She knew what we wanted because she

listened to us. She helped us immensely through the stages

of buying a house and gave us good advice. Anne Plummer & Associates was conveniently

located and a very comfortable place for the closing.

They made buying this house simple and actually fun.

Ginnie, Many thanx for the attentive and professional service you gave us when we bought out wonderful home in Bridgton recently.Trying to sell a house in FL and buy one in Bridgton would

have been incredibly difficult without the email listings you provided.

When we finally came to Maine we were well prepared

as a result of your careful research, and left 5 days later with a signed contract on our current home.

You listened to our needs, stayed focused on those needs, and

steered us in the right direction. The friendship that hat has since developed between us is a blessing.

There are countless real estate agents, but

very few good ones, and you are the latter.”Ed and Marie D.

In June 2014 I moved from my California home to be with my daughter and grand children who moved to Maine in 2013. As a native Californian I did not know much about Maine except that it was cold in the winter. I selected Anne Plummer & Associates because it seemed to have the lion’s share of listings that I viewed on the Internet. Tracy Cox was my Realtor and although new to her profession, she is an excellent listener and did not waste my time looking at properties that did not fit my needs. If she didn’t know an answer, she did not invent something, but told me she would find out the answer. She always was timely with her responses and was punctual for showings. All of the professionals at Anne Plummer & Associates were friendly,knowledgeable and made the buying experience memorable. I recommend this Realtor and Tracy Cox for anyone looking to find property in Maine.

Very good post! We are linking to this particularly great article on our site.

Keep up the good writing.

Take a look at my web-site Noble

I don’t even know how I ended up here, but I thought this post

was good. I do not know who you are but definitely you are going to a famous blogger if you aren’t

already 😉 Cheers! https://www.xmax-yamaha.com